About Steve Young Realtor

Table of ContentsThe Steve Young Realtor PDFsNot known Facts About Steve Young RealtorThe Facts About Steve Young Realtor RevealedThe Best Guide To Steve Young Realtor

For comparison, Wealthfront's ordinary portfolio earned simply under 8% web of costs over the past 8 years. As well as the Wealthfront return is far much more tax effective than the return you would certainly obtain on property due to the method rewards on your Wealthfront portfolio are strained and our tax-loss harvesting - steve young realtor.1% return, you require to have a nose for the neighborhoods that are most likely to appreciate most quickly and/or find a horribly mispriced home to get (right into which you can spend a little quantity of cash and also upgrade into something that can command a much greater rent even much better if you can do the work on your own, however you need to make certain you are being sufficiently made up for that time).

And we're chatting concerning individuals that have large staffs to assist them find the ideal building and also make renovations. It's better to expand your financial investments You need to think about buying a specific residential or commercial property similarly you need to think concerning a financial investment in an individual stock: as a large threat.

The suggestion of trying to select the "right" specific home is appealing, particularly when you assume you can obtain a great offer or buy it with a great deal of utilize. That method can work well in an up market. 2008 taught all of us concerning the threats of an undiversified real estate portfolio, and reminded us that leverage can work both means.

A Biased View of Steve Young Realtor

Liquidity issues The last major argument against possessing financial investment residential or commercial properties is liquidity. Unlike a realty index fund, you can not market your residential or commercial property whenever you want. It can be difficult to forecast how much time it will consider a property to sell (and it often seems like the much more eager you are to market, the longer it takes).

Attempting to gain 3% to 5% more than you would certainly on your index fund is virtually difficult except for a handful of property personal equity investors who attract the most effective and the brightest to do only focus on outshining the market. Do you truly believe you can do it when professionals can't? Our advice on rental residential property investing is consistent with what we advise on other non-index financial investments like stock selecting as well as angel investing: if you're mosting likely to do it, treat it as your "funny money" and also restrict it to 10% of your liquid internet worth (as we explain in Measuring Your House As A Financial investment, you must not treat your home as a financial investment, so you do not need to limit your equity in it to 10% of your liquid internet well worth).

If you own a property that rents out for less than your carrying price, then I would strongly advise you to think about marketing the property as well as rather spend in a varied profile of low-priced index funds.

Over the years, property investment has continuously escalated. Some people select to buy a property to lease on a lasting basis, while others go with short-term leasings for tourists as well as organization vacationers. One area that has seen huge growth in realty investment is Las Las vega. From apartment or condos, single-family residences, as well as view website penthouses to commercial workplaces and retail areas, the city has a large range of homes for budding investors.

A Biased View of Steve Young Realtor

So, is Las Las vega property an excellent financial investment? Allow's discover! Why Las Las Vega is a Great Area to Invest in Property, A great deal of people are relocating to Las Las vega whether it's due to the outstanding climate, no revenue tax obligations, and also an excellent expense of living. That's why the city is continuously ending up being a top realty financial investment destination.

In between the well known Strip, the abundance of resorts, resorts, and also gambling establishments, first-rate entertainment, amazing interior destinations, as well as impressive exterior spots, people will always be drawn to the city. This indicates you're never ever except site visitors seeking a location to remain for a weekend break journey, a long-lasting service, or a home to move to.

These bring in business vacationers as well his response as business owners from all walks of life who, once again, will certainly be looking for somewhere to remain. Having a genuine estate building in the location will be useful for them and make returns for you.

The Best Guide To Steve Young Realtor

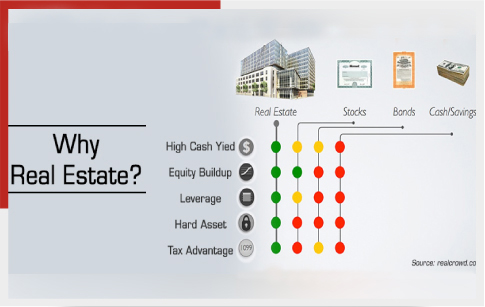

Kind of Property and its Characteristics, It's essential to recognize what kind of real estate residential property you intend to purchase industrial, industrial, domestic, or retail. Residential includes houses, a fundamental human requirement, so this investment is understood to be the best with assured returns. The other three have a tendency to have high risks (such as financial recession as well as vacancies), yet they use higher profit margins.